News

NEW EXTENSION OF THE PROHIBITION TO DISMISS OR SUSPEND EMPLOYEES.

PUBLIC EMERGENCY. Prohibition of dismissals and suspensions. Extension.

On September 23rd, 2020, the National Executive Branch issued Decree No. 761/2020, by means of which

it extended the prohibition to carry out dismissals without a justified cause, suspensions due to force

majeure, lack or reduction of work. The term had already been extended by means of Decree No. 624/20 and

within the framework of Law No. 27,541 that resolved the public emergency in economic, financial, fiscal,

administrative, social security, tariff, energy, health and social matters.

In particular, Decree No. 761/2020 established:

• Dismissals. The prohibition on dismissals without just cause and due to lack or reduction of work and

force majeure is extended for a period of 60 days from the expiration of the term established by Decree 624/20.

• Suspensions. Likewise, the prohibition to carry out suspensions for reasons of force majeure or lack

or reduction of work is extended for a period of 60 days.

• Suspensions regulated in Section 223 bis Labor Contract Law. Lastly, suspensions made under the terms

of article 223 bis of the Labor Contract Law are exempt from this prohibition.

The Decree No. 761/2020 entered into force on the same day of its publication in the Official Gazette, which is why

its expiration will operate on November 22nd, 2020.

Argentine Central Bank Extended Communique “A” 7030

This Communique regulates access to the FX market for the payment of the import of goods’ or debt payments derived from the import of goods, and the repayment of principal of financial indebtedness with foreign-related counterparts.

The Argentine Central Bank, through Communique “A” 7094 dated August 27, 2020, established that certain provisions of Communique “A” 7030 will remain in force up to and including until October 31, 2020 . In addition, within the framework of the exceptions to the requirement to obtain prior BCRA approval to access the FX market when external liquid assets are held in an amount exceeding USD 100,000, will not be considered for purposes of such maximum amount, partially or totally, assets corresponding to funds held in a foreign bank account as a result of foreign financial indebtedness in an amount that does not exceed the equivalent of the outstanding amount of principal and interest, as of this amendment, in the next 365 calendar days. Previously, such period was of 120 calendar days. These same provisions were previously extended up to and including August 31, 2020 by means of Communique “A” 7079 dated July 31, 2020, that also allowed access to the FX market without the BCRA’s prior approval to repay outstanding obligations for the import of goods guaranteed by foreign financial institutions or export credit agencies.

Information and Communication Technology Services are Declared Public and Essential

By means of the Decree No. 690/2020 issued on August 21st, 2020, the Executive Branch declared the services regulated in the Argentine Digital Law as essential public services in competition.

The Argentine Executive Branch modified certain articles of the Information and Communications Technologies Law No. 27078 (Argentine Digital Law), and (i) declared Information and Communications Technology Services, and access to telecommunications networks for and between licensees Information and Communications Technology Services as essential public services, and (ii) suspended the increase in their prices until December 31st, 2020. Decree No. 690/20 reincorporates article 15 to the text of the Argentine Digital Law, which had been repealed by Decree No. 267/2015. This article 15 establishes that Information and Communication Technology Services, as well as access to their networks for and between the licensees of said services, are essential and strategic public services in competition as of the publication of the Decree (Date of publication in the Official Gazette: August 22nd, 2020). Through Section 2 of Decree No. 690/20, Section 48 of the Argentine Digital Law incorporates the provision by which the enforcement authority (Ente Nacional de Comunicaciones or ENACOM) shall regulate the prices of essential public services and strategic Information and Communication Technology Services in competition, as well as those provided in accordance with Universal Service, in addition to those that ENACOM determines for reasons of public interest. The new version of article 48 of the Argentina Digital Law provides that prices must be fair and reasonable, must cover operating costs, aim for efficient provision and a reasonable operating margin. Additionally, ENACOM will regulate the mandatory universal basic service that must be provided under equal conditions by the providers. Section 3 of Decree No. 690/20 incorporates the mobile phone service, in all its forms, as a public service and empowers the enforcement authority to regulate its prices. Prior to the issuance of Decree No. 690/20, the basic telephone service was the only service regulated in the Argentine Digital Law that was considered a public service. Finally, Decree No. 690/20 establishes the suspension of increases or modifications of the prices of Information and Communication Technology Services, and extends it to satellite television services subscription, not regulated under the Argentine Digital Law, from July 31st, 2020 to December 31st, 2020.

Tax Project Levied on Large Wealth Individuals

Congress is debating a bill called "Solidarity and Extraordinary Contribution to Help Mitigate the Effects of the Pandemic" that would establish a tax -complementary to the Personal Assets Tax- on an emergency and one-time basis, which will levy existing assets as of December 31, 2019.

Taxpayers:

(i) Individuals and undivided estates with residency in Argentina, including those individuals of Argentine nationality whose domicile or residence is located

in non-cooperating countries or jurisdictions with low or no taxation, levied over all of their assets in the country and in the exterior, when the total of the

assets, and without deduction of any non-taxable minimum, is equal to or greater than $ 200,000,000 as of 12/31/2019.

(ii) human persons and undivided estates residing abroad for all their assets in Argentina, when the total assets, and without deduction of any non-taxable minimum,

is equal to or greater than $ 200,000,000 as of 12/31/2019.

Substitute Taxpayers:

Individuals or legal entities domiciled in the country, including companies, sole proprietorships and estates located in Argentina, that have the condominium,

use, enjoyment, disposition, possession, custody, administration or custody of assets subject to the extraordinary contribution, that belong to the tax payers

mentioned in (ii) whose valuation exceeds $ 200,000,000.

Taxable basis:

The taxable basis will be made up of the total assets of which they are owners - including contributions made to trusts, private interest foundations

and other structures, participation in companies or other entities of any type without tax registration, and direct or indirect participation in companies

or other entities of any kind - existing as of 12/31/2019.

As to assets located abroad, the differential with respect to assets located in the country will be eliminated, in the case of verifying the repatriation of

the assets within 60 days of the publication of the law, provided that said repatriation is equal to or more than 30% of its financial holdings abroad. Repatriation,

upon entering the country, shall be understood to be: (i) holdings of foreign currency abroad and, (ii) amounts generated as a result of the realization of

financial assets belonging to individuals domiciled in the country and undivided estates located in Argentina.

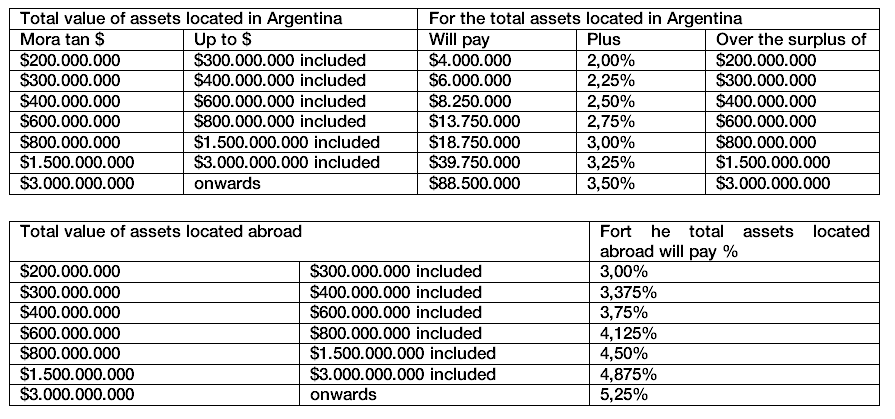

Applicable rates:

This is a tax that will bring a lot of dissent and litigation because it could be argued in Court that it breached basic

constitutional principles, including non-confiscation and reasonableness.

New Tax Moratorium.

On August 14, 2020, a Law was enacted by the Argentine Congress that broadens the scope of application of the Regime for the Regularization of Tax Debts and Social Security, previously in force only for those taxpayers that are registered as Micro, Small or Medium-sized Enterprises.

The “Law to Extend the regularization regime for tax obligations to alleviate the effects of the COVID-19 pandemic”

was passed in the Argentine Congress, to increase the application and scope of the Regularization Regime of Tax, Customs

and Social Security Obligations (the "Regime"), currently in force only for Micro, Small or Medium-sized Companies (“MiPyMEs”)

and non-profit civil entities through Law Nº 27,541.

Main aspects are the following:

• Allows taxpayers that enroll in the Regime to regularize taxes and social security obligations applied, collected and audited by the Argentine Tax Authority

(“AFIP”), expired as of July 31, 2020. Refinancing of payment plans in force and emerging debts of expired plans are also included, amongst others.

• Sets forth the expansion of the Regime in favor of all taxpayers, and all those responsible for taxes and social security obligations applied, collected

and audited by the AFIP, to enroll in the Regime.

• Excludes all debts related with labor insurance system, and social system contributions destined to social security services.

• The following taxpayers are excluded from the Regime: human or legal entities that do not have the condition of: i) MiPyMES; ii) non-profit

entities and community organizations registered as foundations, civil associations, simple associations and entities with municipal recognition and that,

with their own domicile and that of their directors established in national territory, do not pursue profit purposes directly or indirectly and develop

programs for the promotion and protection of rights or direct social aid activities; and iii) natural persons and undivided inheritances that are

considered small taxpayers in the terms determined by the AFIP, possess financial assets located abroad, unless the repatriation of at least thirty

percent (30%) of the proceeds of their realization, directly or indirectly, is verified, within sixty (60) days from accessing the Regime.

• In the case of legal entities, the condition of repatriation is applicable to their partners and shareholders, direct and indirect, who own a percentage

of no less than thirty percent (30%) of their share capital.

• Transitory unions, collaboration groups, cooperation consortia, associations without legal existence as legal entities, non-corporate groups or any

other individual or collective entity, including trusts, are also included.

• Submission must be made up until October 31, 2020.

• The liabilities or claims that are in the course of administrative discussion or subject to administrative or judicial proceedings can also be regularized.

• The total cancellation of the debt under the conditions provided in the Extension Law is proposed to be extended to the benefits for the

extinction of the tax or customs criminal action, for those liabilities which are identical to the ones that can be regulated, and were canceled

before the law amending application.

• The taxpayers that adhere while complying with the expected payments, will have the following exemptions and/or pardon: 1) certian fines and other

penalties; one hundred percent (100%) of the compensatory and / or punitive interest of the principal owed and adhered to the Regime corresponding to

the contribution provided in article 10, subsection c), of law No. 24.241 and its amendments, of self-employed workers included in article 2, subsection b),

of the aforementioned legal rule; 3) of the compensatory and / or punitive interests and customs taxes (including amounts that in the concept of export

incentives should be returned to the AFIP) in the amount that for the total interest exceeds the percentage that for each case is established as follows:

Fiscal period 2018, 2019, and obligations due as of July 31, 2020: ten percent (10%) of the principal owed; Fiscal periods 2016 and 2017:

twenty-five percent (25%) of the principal owed; Fiscal periods 2014 and 2015: fifty percent (50%) of the principal owed; and Fiscal periods 2013 and prior

years: seventy-five percent (75%) of the principal owed. There are some conditions for the benefits to apply.

• Payment plan maximum term varies on the taxes and taxpayers. Social Security obligations 60 or 48 installments, depending if the taxpayer is a MiPyMES,

non-profit entities and community-based organizations registered such as foundations, civil associations, simple associations and entities with municipal

recognition, and human persons and undivided estates that are considered small taxpayers in the terms established by the AFIP, or none of the prior.

For all remaing obligations, 120 or 96 installments, in accordance to the same distinction.

• The Law sets forth the suspension for a period of one year of the course of the statute of limitation on any action to determine or require the payment

of the taxes whose application, perception and supervision is made by the AFIP, and to apply fines in relation to them, as well as the expiration of the instance

in the trials of tax executions or judicial remedies..

A new Resolution from the Public Registry of Commerce (IGJ) requires gender parity in the administration boards of certain entities in the City of Buenos Aires.

The IGJ through General Resolution 34/2020, in force since August 5, 2020, establishes minimum parameters in terms of gender diversity for the composition of the administration and control bodies of certain associations, companies and foundations in the City of Buenos Aires.

This General Resolution No. 34/2020 establishes that civil associations, simple associations, certain corporations -as long as they are or remain comprised by certain specific cases contemplated by section 299, of Law No. 19,550 (“ACL”) -, foundations with a temporary and elective integration board of directors and state companies (Law No. 20705) must include in their board of directors, and where appropriate in their supervisory committee, control body, a composition that respects gender diversity. The aforementioned bodies must be composed of: (i) in the case of an even composition, by the same number of women as men; (ii) in the case of an odd composition, with a minimum of one third of women. This Resolutions, which is only valid in the City of Buenos Aires, will be applicable both for legal entities described above, which are in the process of incorporation or are to be incorporated, as well as those already registered within the IGJ. In this second case, the adjustment must be made for the appointments of the members of the board of directors and, if applicable, of the supervisory committee, appointed after the Resolution comes into effect. The Resolution does not include limited liability companies, corporations not included in article 299 of the ACL and those that, even being comprised by said section, make a public offer of their shares or debentures, have capital stock exceeding ARS 50 million and sole shareholder corporations. On the other hand, the Resolution requires the inclusion in the Annual Report of a description of the gender policy applied to the board of directors, including its objectives, the measures adopted, the way in which they have been applied, in particular, the procedures to procure a number of women on the board of directors that allows for a balanced presence of women and men. Finally, the Public Registry of Commerce may, upon an express request in this regard, exempt from the provisions of the Resolution, in a whole, partially, transitory or definitive manner, the legal entity that may be required, based only on singular, extraordinary, understandable and objective circumstances, derived from its constitutive background and / or type of conformation and / or social activity aimed at achieving its purpose.